Though auto insurance companies largely base premiums on a motorist’s driving record, address, age, gender, marital status and credit rating, the make and model of car one drives is also a determining factor. As one might imagine, pricier cars tend to carry higher premiums than more-affordable models. “The more expensive the car the more it typically costs to repair, especially when you consider exotic materials being used in some of these autos like aluminum and carbon fiber,” explains Terrence Cahill, director of communications for 21st Century Insurance. Beyond that, insurance companies base their rates on claims histories, including how much damage a given model incurs in a typical crash, the extent of injuries (and fatalities) suffered by occupants and other parties, the cost of damage to other vehicles and property and which models are more or less likely to be stolen.

We’ve compiled a slideshow of the top 20 most-expensive rides to insure as determined by Insurance.com, along with their average anticipated premium costs. Be aware that the amounts given are perfect-world averages based upon a hypothetical single 40-year-old male with a clean driving record commuting 12 miles to work each day, with typical coverage limits. Many drivers – especially those living in large metropolitan areas and having one or more accidents and/or moving violations on their records can expect to pay higher premiums, and in many cases substantially more.

For example, a recent survey found that registering even a single moving violation can boost car insurance rates by between 12 and 22 percent depending on the infraction. A comprehensive zip code analysis by CarInsurance.com determined that, all else being equal, a motorist living in Highland Park, Mich. would pay around 577 percent more for car insurance than the same person residing in the sleepy burg of Bullhead City, Ariz.

And that’s if a given motorist can obtain coverage at all. Some companies may choose not to cover certain high-performance autos altogether, and many will opt to take a pass on motorists having several blemishes on his or her driving record, especially if they’re driving what’s considered a high-risk model.

The fine print: Insure.com’s survey was conducted earlier this year by Quadrant Information Services, and based on rates using data on 900 model-year 2012 car models from six large carriers (Allstate, Farmers, GEICO, Nationwide, Progressive and State Farm) in 10 ZIP codes per state. Estimates are based on an unmarried 40-year-old male driver with no accidents or moving violations who drives 12 miles to work each day, with policy limits of 100/300/50 ($100,000 for injury liability for one person, $300,000 for all injuries and $50,000 for property damage in an accident) and a $500 deductible on collision and comprehensive coverage.

Audi R8 Spyder Quattro

Average 2012 Premium according to Insure.com: $3,384.

Also: Audi R8 4.2 Coupe, $2,903.

Mercedes-Benz CL600

Average 2012 Premium: $3,307.

Also: CL65 AMG, $2,669; CL63 AMG, $2,613.

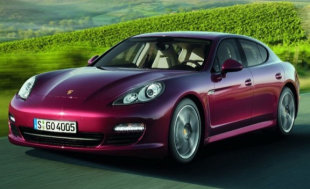

Porsche Panamera Turbo

Average 2012 premium: $2,738.

BMW ActiveHybrid 7

Average 2012 Premium: $2,701.

Also: ActiveHybrid 7 L, $2,641; 750xi, $2,446; 750i, $2,430.

Porsche 911 Turbo Convertible

Average 2012 premium: $2,674